Learn how blockchain and smart contracts improve cybersecurity factors in online transactions, remove the element of fraud, and promote trust with automation and transparency.

In this connected age, where data breaches and online fraud are rising concerns, blockchain technology and smart contracts have become powerful solutions for secure transactions. Their ability to provide transparency, remove middlemen, and enable fraud-resistant mechanisms has made them a key part of today’s financial systems and more.

How Blockchain Builds a Secure Foundation

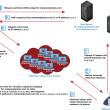

Blockchain is best known as the technology behind cryptocurrencies like Bitcoin and Ethereum, but its uses go well beyond digital currencies. It works as a decentralized ledger, recording transactions across multiple points in a network, which makes it incredibly secure and nearly impossible for cybercriminals to tamper with or hack.

When it comes to digital payments, this decentralization is key. Traditional payment systems rely on central authorities, which are vulnerable to malware attacks, breaches and fraud.

Blockchain, on the other hand, distributes the transaction record across a network, reducing the risk of a single point of failure. The stability of blockchain also means that once a transaction is recorded, it cannot be changed, adding another layer of trust and accountability.

The Role of Smart Contracts

Smart contracts take blockchain’s security a step further. These self-executing agreements operate based on established criteria rules written into code. Once the conditions are met, the contract automatically executes, removing the need for intermediaries.

For example, imagine buying a digital service. A smart contract can be programmed to release payment only when the service is delivered and verified. This reduces the risk of fraud and disputes, as the terms are enforced automatically.

Another benefit is efficiency. By automating processes, smart contracts not only save time but also reduce costs associated with manual verification and third-party oversight. This makes them especially appealing for industries like supply chain management, insurance, and real estate, where trust and speed are paramount.

However, security vulnerabilities have also affected smart contracts, which need to be addressed by skilled blockchain developers or specialized auditing teams. According to Onchainpay, a European secure cryptocurrency payment gateway, smart contract vulnerabilities are one single major factor that continues to pose security risks within the blockchain infrastructure.

A recent systematic literature review identified 101 distinct vulnerabilities in Ethereum smart contracts, categorized into ten groups. In particular, in the first quarter of 2024 alone, exploits targeting these vulnerabilities resulted in nearly $45 million in losses across 16 incidents, averaging $2.8 million per exploit.

Real-World Applications

Nevertheless, despite ups and downs, Blockchain and smart contracts are already being used to secure payments and transactions globally. As noticed by Halborn, Microsoft, JPMorgan Chase, Walmart, IBM and Amazon are just some major examples.

In international payments, they enable faster and more transparent transfers without the hefty fees associated with traditional banking. In e-commerce, smart contracts can automate escrow services, protecting both buyers and sellers.

Even outside of payments, blockchain is enhancing security. From safeguarding healthcare records to verifying the authenticity of luxury goods, its applications are vast.

What This Means for Businesses

As cybersecurity threats grow, businesses opting for blockchain and smart contracts gain a competitive advantage in security and efficiency. For consumers, this means safer and more reliable transactions.

While the technology isn’t without challenges, such as regulatory hurdles and technical complexity, its benefits are clear. Businesses looking to adopt secure payment systems should consider solutions that leverage blockchain and smart contracts to protect their data and enhance trust in their transactions.

RELATED TOPICS

- 6 of the Best Crypto Bug Bounty Programs

- 5 Platforms for Identifying Smart Contract Vulnerabilities

- Growing Importance of Secure Crypto Payment Gateways

- Best Crypto Marketing Agencies for Web3 Security Brands

- Why Hosting firms have started accepting crypto payments

- Top 5 Platforms for Identifying Smart Contract Vulnerabilities