Cyberattacks are no longer just IT problems. They are financial events that can shake an entire business. A single breach can drain revenue, trigger regulatory fines, and erode years of customer trust.

What once lived in server rooms is now a boardroom priority that shapes budgets, investor confidence, and long-term strategy. For today’s financial and security leaders, understanding the real cost of a data breach is essential to protecting enterprise value and building lasting resilience

Counting the Direct Costs

When a company experiences a data breach, the financial damage is both immediate and extensive. Beyond the technical response, businesses face recovery costs, legal fees, customer compensation, and revenue losses that can cripple operations.

This exposure is increasing as geopolitical instability grows. State-sponsored attacks have become more common, with businesses caught in the crossfire of economic and political tensions. These incidents blur the line between criminal activity and national strategy, creating new financial and operational risks for companies across sectors.

According to the IBM “Cost of a Data Breach” Report 2022, the global average cost of a data breach reached USD 4.35 million, the highest recorded at the time. The study also found that breaches in critical sectors such as healthcare and finance are consistently among the most expensive, reflecting the growing complexity and scale of cyber incidents.

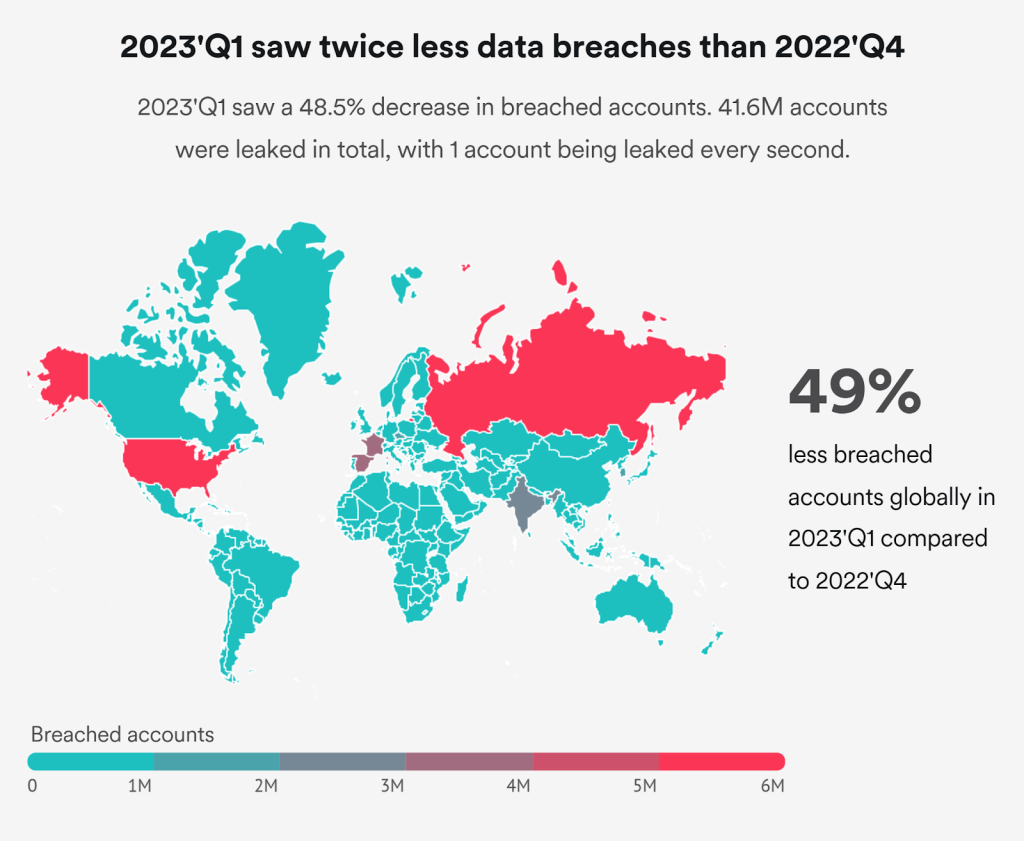

Even with temporary declines in reported breaches, as the infographic shows, the financial cost per incident continues to climb. Fewer breaches do not mean less risk. Each event is more damaging, both financially and operationally.

Every day, direct expenses include:

- Legal settlements and regulatory fines

- Customer notification and compensation

- Technical investigation and incident response

- Temporary system shutdowns and lost transactions

For organisations that handle sensitive or regulated data, these costs can rise sharply. In my experience working across technology and finance, a single data breach can destabilise cash flow, pause acquisitions, and erode investor confidence. For CFOs and CISOs, this is not a technology issue; it is a financial risk that directly shapes enterprise value.

The Hidden Cost of Lost Trust

Beyond the numbers, trust is the most valuable currency in business. Once it is lost, it takes years to rebuild. Customers today expect their data to be protected as carefully as their money. When that trust is broken, even loyal clients reconsider their relationships.

According to studies, one in three affected consumers stated they will never return to purchase from the breached retailer. This highlights how quickly reputational damage translates into financial loss. Competitors step in to capture dissatisfied customers, while restoring confidence often requires significant investments in communication, security improvements, and brand rebuilding.

Reputational harm also affects investors, insurers, and business partners. Confidence drops, premiums rise, and compliance demands increase. These effects rarely appear in financial statements but often exceed the immediate cost of the breach itself.

Downtime and Revenue Disruption

A significant breach often forces companies to take critical systems offline while teams investigate and patch vulnerabilities. This downtime can paralyse operations.

For digital-first businesses, even a few hours of outage can mean millions in lost revenue. Retailers lose online sales. Financial firms miss trading opportunities. Service providers face customer refunds and contract penalties.

These are the opportunity costs that rarely appear in public reports. The longer the disruption, the higher the cumulative impact on revenue, market share, and brand reliability.

The Notional and Long-Term Costs

Some losses are invisible but just as damaging. These include management distraction, missed strategic opportunities, and delayed innovation. When leadership shifts its focus from growth to crisis control, productivity across the organisation drops. Projects are postponed. Risk appetite decreases. The company becomes more reactive and less innovative.

According to the CISA “Cost of a Cyber Incident” Study (PDF), the indirect or downstream costs of a data breach, such as reputational damage, lost productivity, and opportunity costs, can equal or even exceed the direct financial impact. These findings show that the economic harm of a breach continues to grow long after the technical recovery is complete.

These notional costs add up over time. They may not appear in financial statements, but they slow recovery and compound the damage. The longer the recovery period, the higher the actual financial burden of the breach.

Why Cybersecurity Is a Strategic Investment

Too often, cybersecurity is seen as a cost rather than an investment. But companies that invest in strong protection systems early often save millions later. This need for early investment has become even more critical as cyber warfare evolves. Threats are no longer confined to individual hackers or isolated breaches. They now involve organised groups and state-backed operations that target supply chains, financial systems, and critical infrastructure. For business leaders, this shift reinforces the idea that cybersecurity is not only a technical safeguard but a strategic defence capability.

According to SecurityMetrics, organisations with robust cybersecurity frameworks experience fewer breaches, shorter downtime, and lower recovery costs. They also benefit from lower cyber insurance premiums and greater customer loyalty.

From a CFO’s perspective, cybersecurity is risk management. From a CISO’s perspective, it’s operational resilience. Together, these two viewpoints create a stronger business foundation.

Investing in cybersecurity doesn’t just prevent loss. It protects brand equity, maintains investor confidence, and supports long-term digital growth.

How to Choose the Right Cybersecurity Partner

Selecting the right cybersecurity partner is a key strategic decision. The wrong choice can leave gaps that expose your organisation to risk. Here’s what to consider when choosing a vendor:

1. Identify Your Risks

Every business faces unique threats. Map out where your critical data resides, who can access it, and what could go wrong if it’s exposed. Start by assessing your most valuable assets and high-risk operations.

2. Check Proven Performance

Choose vendors with a track record of handling real incidents at scale. Ask for references, review case studies, and ensure they have certified experts who can respond quickly.

3. Look for Seamless Integration

Cybersecurity tools must work within your existing systems. A solution that requires constant manual input or creates workflow friction will be ignored by teams. Integration ensures security becomes part of daily operations.

4. Demand Transparency

Good vendors don’t just fix problems; they teach your teams how to prevent them. Look for partners who share their methods and offer post-incident training or knowledge transfer.

5. Think Beyond Compliance

Regulatory compliance is a baseline, not the finish line. Choose a vendor who focuses on long-term resilience, continuous monitoring, and proactive defence strategies.

Aligning Financial and Security Goals

CISOs and CFOs need to speak a common language. The CISO’s focus is to reduce risk. The CFO’s focus is to control costs. But in cybersecurity, both goals align naturally.

Every dollar spent on prevention can save many more in remediation and recovery. When security spending is linked to financial outcomes, such as reduced insurance costs or higher investor confidence, it becomes easier to justify and sustain.

Cybersecurity should be seen as capital protection. It preserves enterprise value and ensures operational continuity, especially in a landscape where digital trust is a major differentiator.

Looking Ahead: Turning Risk into Opportunity

Data breaches are no longer rare events. They’re an expected risk in a connected economy. The difference between a crisis and a recovery story lies in preparation.

Businesses that invest in cybersecurity are not just protecting themselves. Instead, they’re gaining a competitive edge. They can innovate faster, win customer trust, and maintain stability when others are scrambling to react.

The true cost of a data breach includes every dollar, every customer, and every opportunity lost. But the return on investing in cybersecurity extends far beyond prevention. It’s about building confidence, credibility, and long-term resilience.

Final Thoughts: Make Prevention Part of Your Financial Playbook

Over my years working across finance and technology, I’ve seen one lesson repeat itself: prevention always costs less than recovery. The financial and reputational harm of a data breach can be enormous, but it’s also avoidable with foresight and investment.

Cybersecurity is not just a technical safeguard. It’s a strategic financial decision that protects value, trust, and future growth.

References

- Cybersecurity and Infrastructure Security Agency. (2020). Cost of a Cyber Incident: Systematic Review nd Cross-Validation. https://www.cisa.gov/sites/default/files/2024-10/CISA-OCE%20Cost%20of%20Cyber%20Incidents%20Study_508.pdf

- Digital Formation World. (May 2023). Global Data Breach Statistics In Focus: Where Do The Trends Stand In 2023? https://www.digitalinformationworld.com/2023/05/global-data-breach-statistics-in-focus.html

- IBM. (2022). IBM Report: Consumers Pay the Price as Data Breach Costs Reach All-Time High. https://newsroom.ibm.com/2022-07-27-IBM-Report-Consumers-Pay-the-Price-as-Data-Breach-Costs-Reach-All-Time-High

- MDPI. (2022). Consumers’ Change in Trust and Security after a Personal Data Breach in Online Shopping. https://www.mdpi.com/2071-1050/14/10/5866

- Security Metrics. (n.d.). How Much Does a Data Breach Cost Your Organisation? https://www.securitymetrics.com/blog/how-much-does-data-breach-cost-your-organization