SUMMARY:

- Crypto losses in November 2024 totalled $71 million, marking a 79% decrease from the same month in 2023.

- DeFi projects accounted for all reported losses, with no major CeFi incidents recorded.

- BNB Chain became the top target for attacks, hosting 46.7% of incidents, surpassing Ethereum.

- 99.96% of funds lost in November came from hacking, while rug pulls accounted for less than $26,000.

- Year-to-date losses in 2024 reached $1.48 billion, a 15% reduction compared to 2023.

- The $1.48 billion lost to hacks and scams in 2024 shows risks despite a 15% drop compared to the previous year.

The cryptocurrency industry saw a surprising decrease in losses last month, according to a new report from Immunefi, a leading blockchain security platform. While decentralized finance (DeFi) projects continued to be a prime target, the overall figures show a promising trend.

The Immunefi report, shared with Hackread.com, reveals that $71 million was lost to hacks and rug pulls in November 2024, a notable 79% drop from the same month last year.

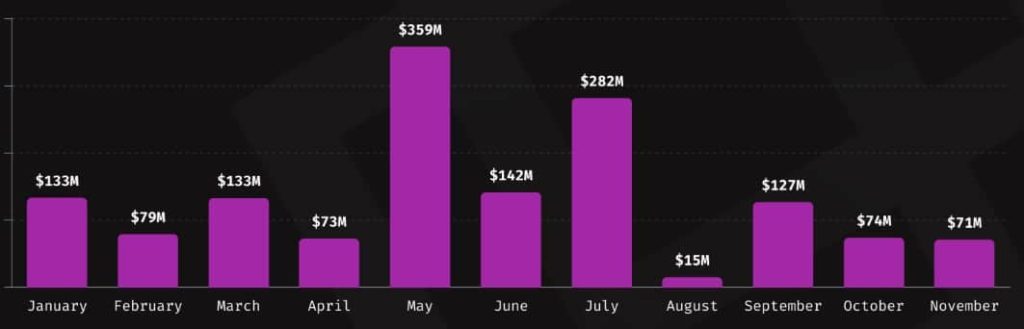

That figure, while still large, is the second-lowest monthly total this year and means a 79% decrease compared to November of last year. Overall, for 2024, the crypto industry has lost $1.48 billion ($1,489,921,677). While this is a considerable number, it is a 15% drop compared to the same period of 2023, suggesting progress in cybersecurity measures.

DeFi: Still a Magnet for Malicious Activity

Immunefi’s findings suggest that all $71 million in losses happened in the DeFi sector, with not a single report of a major hack or exploit affecting CeFi (centralized exchanges). Two noteworthy incidents that stand out are Thala Labs, a decentralized finance firm, lost $25.5 million, and the memecoin trading platform DEXX saw a $21 million loss.

Hacks Continue to Dominate, Minimal Rug Pulls

It’s not just the type of platform that shows a trend; the type of attack also shows clear patterns. Of all the funds stolen in November, 99.96% came from direct hacking incidents. Only a tiny fraction, $25,300, was lost through what are called “rug pulls,” where developers abandon a project after raising funds. This suggests that while scams do occur, the more sophisticated exploits are the more damaging threat.

BNB Chain Takes the Spotlight, Ethereum Drops Back

The report showed a switch in which the blockchain network was targeted most often. In November, the BNB Chain surpassed Ethereum to become the leading target, hosting nearly half (46.7%) of all attacks. Ethereum came second with 30% of attacks. The rest of the incidents were found across several other networks.

What Does This Mean?

The Immunefi report shows a mixed situation for crypto security. While overall losses are down for the year, the dominance of DeFi exploits and the shift of attacker focus to BNB Chain means the fight is far from over.

While the overall loss figure is down, the YTD (year-to-date) total of $1.48 billion lost to hacks and scams still shows a considerable sum. Nevertheless, Immunefi’s report shows that the blockchain industry cannot afford to overlook vulnerabilities and scams, making a solid cybersecurity plan essential.