Once known primarily in their home regions, these actors are now winning over audiences in Northern India, thanks to the rise of Pan-India films. This shift is reshaping India’s entertainment scene, blurring the lines between Bollywood and regional cinema.

But what does this change mean for the future of Indian cinema? Understanding this trend requires more than box office numbers. It demands deeper insights into how audiences are reacting in real time and what drives their engagement.

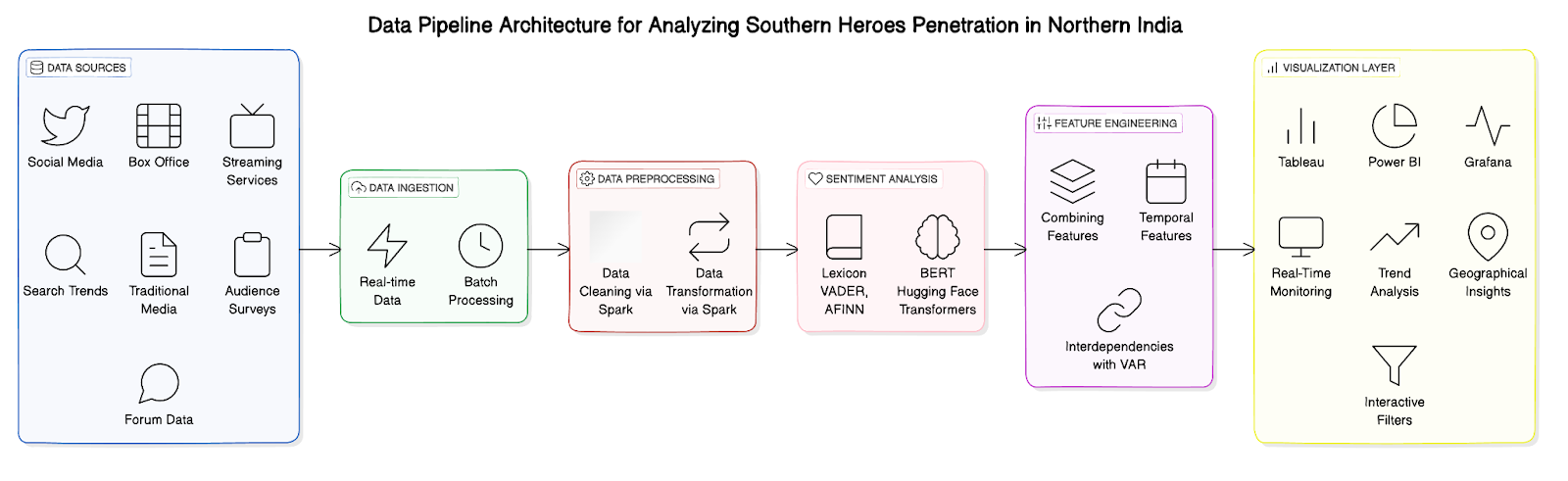

To uncover these patterns, we proposed a real-time data pipeline. This system integrates information from multiple sources—social media, streaming platforms, box office revenues, search trends, and audience surveys.

With this data, we measure the popularity and cultural impact of Southern stars, helping movie producers and talent managers adjust their strategies on the go.

The Shift in Audience Preferences

The growing presence of Southern actors in Northern India is part of a broader trend powered by Pan-India films. These movies, designed to appeal to audiences across regions, feature actors who are no longer limited by geography or language.

However, tracking this shift isn’t straightforward. Audience tastes change rapidly, and simple metrics like social media buzz or ticket sales can only tell part of the story. A more integrated approach is needed to get the full picture of audience behaviour across platforms.

The Real-Time Data Pipeline: A New Way to Track Trends

Our research introduces a real-time data integration pipeline that pulls together multiple sources of information. This approach provides up-to-the-minute insights into how Northern audiences are engaging with Southern stars.

The system relies on three key performance indicators:

- Regional Popularity Index (RPI): Measures how well an actor connects with audiences across regions by combining social media sentiment and box office results.

- Cultural Acceptance Indicator (CAI): Tracks how much an actor’s popularity aligns with cultural preferences using survey responses and search trends.

- Engagement Index (EI): Assesses overall interaction by analyzing streaming views and media mentions.

These metrics allow production houses to fine-tune marketing efforts based on real-time feedback from audiences.

How the Data Pipeline Works

Data Collection

Our system pulls data from a variety of sources:

- Social Media Platforms: Twitter, Instagram, Facebook, Reddit, TikTok, and YouTube. Metrics include mentions, hashtags, likes, shares, and follower counts.

- Box Office Data: Ticket sales and collections from sources like Box Office India and Bollywood Hungama.

- Streaming Platforms: Data from FlixPatrol, Parrot Analytics, and SimilarWeb, capturing regional viewership and engagement.

- Search Trends: Google and Bing Trends track public interest in actors.

- Media and Surveys: Mentions in news outlets, plus audience surveys on preferences and sentiment.

Processing and Analyzing Data

The data flows into a central data lake—a unified storage system like Amazon S3 or Hadoop. Once collected, it goes through cleaning and transformation using tools like Apache Spark and Python.

- Sentiment Analysis: We apply tools like VADER and AFINN to score sentiment in social media posts. For more detailed insights, BERT models capture the context behind mentions and comments.

- Feature Engineering and Temporal Analysis: Temporal models detect patterns over time, such as spikes in engagement before a movie release. These insights are combined with survey data, streaming metrics, and box office performance to compute the core indices.

Key Metrics: How We Measure Success

Each of the three core metrics provides actionable insights:

- Regional Popularity Index (RPI):

Formula: RPI = (W1 × Sentiment Score) + (W2 × Box Office Performance) - Cultural Acceptance Indicator (CAI):

Formula: CAI = (W1 × Survey Positive Rate) + (W2 × Search Volume Index) - Engagement Index (EI):

Formula: EI = (W1 × Streaming Views) + (W2 × Media Mentions)

These metrics help stakeholders adapt their strategies quickly—whether by tweaking marketing campaigns or prioritizing certain platforms.

Visualizing Trends in Real Time

To make these insights useful, we proposed a real-time dashboard using tools like Tableau, Power BI, or Grafana. The dashboard offers:

- Trend Analysis: Line charts tracking sentiment and engagement over time.

- Geographic Insights: Heatmaps showing how different regions respond to Southern stars.

- Alerts and Notifications: Automated alerts for sudden changes in engagement or audience sentiment.

This visualization allows production houses and talent managers to stay on top of trends and respond quickly to shifting audience behaviour.

Conclusion: Discovering the New Entertainment Landscape

This real-time data pipeline gives a complete picture of audience dynamics, showing how Southern stars are gaining traction in Northern markets. Integrating data from social media, box offices, streaming platforms, and surveys provides timely, actionable insights that help production teams optimize their strategies.

Looking ahead, future versions of the system could include localized social media platforms and predictive analytics powered by machine learning. Expanding the analysis to other regions would also give a broader view of how cross-regional preferences are evolving.

In an entertainment market where trends shift rapidly, this data-driven approach will be essential for staying ahead of the curve.