The finance and healthcare industries are rapidly advancing through digital transformation, integrating tech to enhance services and security. From AI-driven innovations to secure cloud migration, transformation meets rising demands in efficiency, compliance, and data security.

Industries such as finance and healthcare face constant pressure to innovate, deliver better services, and respond quickly to growing consumer needs. These two sectors are critical to every aspect of human life, and their transformation through technology is advancing at a great pace.

A powerful driver behind this change is digital transformation, a methodology that integrates new technologies into every aspect of an organization. This transformation helps companies in finance and healthcare streamline operations, improve customer experiences, and optimize outcomes while staying competitive.

What is Digital Transformation?

Digital transformation refers to the integration of digital technologies into all areas of a business. It changes how organizations operate and deliver value to customers. This transformation allows businesses to modernize legacy processes, improve operational efficiencies, and meet fast-evolving customer expectations.

Unlike traditional processes, digital transformation powers automation, data analytics, cloud computing, and more to create more agile, scalable, and efficient systems. In sectors like finance and healthcare, where compliance, cybersecurity, and efficiency are critical; digital transformation drives major changes.

The Impact of Digital Transformation on Financial Technology

According to Gaurav Sharma, Senior Manager of Software Engineering at Capital One, financial institutions—historically risk-averse and reliant on legacy systems—are adopting digital transformation to remain competitive and enhance customer experiences.

The rise of FinTech, which refers to technology-driven financial services, is pushing traditional banks, insurance companies, and credit unions to innovate at an accelerated pace. This push is backed by the fact that customers prefer mobile banking, contactless payments, and blockchain technologies.

1. Accelerating Innovation and Delivery

Digital transformation enables financial institutions to innovate and deliver new products and services more quickly. Traditional development cycles often took months due to strict testing guidelines, regulatory compliance, and the need for system reliability. However, with modern technologies like cloud computing and continuous deployment frameworks, financial organizations can now release updates and new services with far greater speed, all while maintaining security and compliance.

Global banks, for instance, have adopted digital transformation to deliver mobile banking apps and digital wallet features faster, giving them an edge in a highly competitive market. Speed is essential in a world where customer satisfaction increasingly depends on smooth digital experiences. Whether it’s secure payment gateways, fraud detection tools, or user-friendly interfaces, digital transformation allows financial services to keep pace with customer demands.

2. Enhancing Security and Compliance

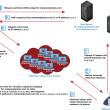

Cybersecurity is non-negotiable in the financial sector, where cyberattacks and data breaches present massive risks. Through digital transformation, financial institutions can build security in every stage of their operations. Advanced cybersecurity measures, real-time threat detection, and automated compliance monitoring are key components of this shift.

While cyberattacks on financial firms are increasing; institutions must balance the use of new technology with proper cybersecurity measures. Digital transformation can help maintain this balance by making sure customer data, financial transactions, and payment systems are secure from hackers, without slowing down development or deployment.

3. Cloud Migration and Efficiency Gains

Many financial institutions are moving their systems to the cloud, recognizing the need for scalability and cost savings. Cloud migration reduces infrastructure costs, enhances disaster recovery capabilities, and allows institutions to scale globally with ease. Digital transformation facilitates this migration by automating complex operations and enabling the seamless deployment of applications in cloud environments.

By leveraging cloud platforms like AWS, Azure, and Google Cloud, financial institutions not only reduce operational costs but also gain the agility to respond quickly to changing market demands. This flexibility became especially important during the COVID-19 pandemic when remote operations and digital banking became the norm.

Digital Transformation in Healthcare Technology

While financial services benefit from increased efficiency, the healthcare sector must balance innovation with patient safety, privacy, and regulatory compliance. The healthcare industry has seen tremendous growth in areas like telemedicine, electronic health records (EHR), wearable devices, and personalized medicine, all driven by digital transformation.

1. Expanding Telemedicine and EHR Systems

The demand for telemedicine services has surged, particularly in the wake of the global pandemic. Healthcare providers are increasingly adopting digital solutions to deliver virtual consultations, online diagnostics, and remote patient monitoring. Digital transformation enables the rapid development and deployment of these solutions, ensuring they are scalable, secure, and user-friendly.

Moreover, EHR systems are evolving to become more interoperable, allowing healthcare providers to share patient data more easily across different organizations and systems. By adopting digital transformation strategies, HealthTech, companies can integrate and deploy these systems more efficiently, enhancing patient-centric care while meeting stringent data protection regulations.

2. Continuous Improvement through Data Analytics

In healthcare, there is little room for error when deploying new technologies, as mistakes can have serious consequences for patient safety. Digital transformation enables continuous monitoring of healthcare applications and systems, ensuring that issues are identified and resolved quickly. This capability is especially vital in managing medical records, medication dispensing, and patient monitoring.

By integrating real-time feedback from healthcare providers and clinical data, digital transformation supports the rapid improvement of healthcare technologies. This iterative process ensures that solutions evolve in response to real-world needs, all while maintaining accuracy and reliability.

3. Strengthening Data Security and Compliance

Like finance, healthcare is a sector where data security is paramount. Patient data is highly sensitive, and any breaches could result in significant financial and personal harm. Digital transformation embeds security into every stage of technology development, ensuring that systems and applications meet regulatory standards like HIPAA and the General Data Protection Regulation (GDPR).

Automation, integrated compliance checks, and advanced security protocols help healthcare organizations maintain the highest standards of data protection without slowing down technological advancement. For both established healthcare providers and new digital health startups, adhering to these regulations is critical to operating safely in the industry.

The Future of Digital Transformation in Financial and Healthcare Technology

The ongoing shift toward digital transformation in finance and healthcare is not just reshaping how these sectors operate; it’s revolutionizing entire industries. As technologies such as blockchain, artificial intelligence (AI), and machine learning continue to evolve, digital transformation will become even more essential in managing complexity and delivering superior services.

1. AI-Driven Financial Services and Predictive Healthcare

Financial institutions are already using AI-driven algorithms for tasks like fraud detection and predictive analytics. In healthcare, AI is being used to forecast patient outcomes and personalize treatment plans. By integrating AI into digital transformation frameworks, companies in both sectors can continuously refine their services, making them more efficient and responsive to user needs.

2. Blockchain for Secure Transactions and Medical Records

Blockchain technology offers enormous potential for both financial transactions and secure medical records. Digital transformation ensures that blockchain applications are developed and deployed rapidly, providing secure, decentralized solutions that meet the growing demands of customers and healthcare providers alike.

Conclusion

The financial and healthcare sectors are experiencing unprecedented transformation through digital technologies. By embracing digital transformation, these industries are becoming more agile, efficient, and secure, enabling them to adapt to evolving customer expectations and regulatory environments. This ongoing transformation isn’t just about improving processes; it’s about positioning these sectors to meet the challenges of the future head-on.

RELATED TOPICS

- The Human Factor in Cybersecurity and Financial Decisions

- How Artificial Intelligence (AI) is Impacting Modern Healthcare

- AI in Healthcare: ChatGPT Helps Get Diagnosis After Doctors Fail

- Digital Transformation in the Financial Industry: The Role of Fintech

- ChatGPT Improve Healthcare, But Industry Needs Secure Database